Invest in tomorrow's manufacturing today.

Earn passive income, diversify your portfolio, and own a piece of Avigna’s strategic network of factories & warehouses– India’s first and only modular factory INVIT (as far as we know and we know quite a bit, if we may say so ourselves)through Avigna Atlas.

Simply speaking, unlock an exciting new investment product you can effortlessly monitor and manage.

First 500 investors may get an opportunity to invest in Avigna next round of funding.

Avigna Select Blue

Chip Partner Companies

Industrial & Warehousing rental investing, simplified.

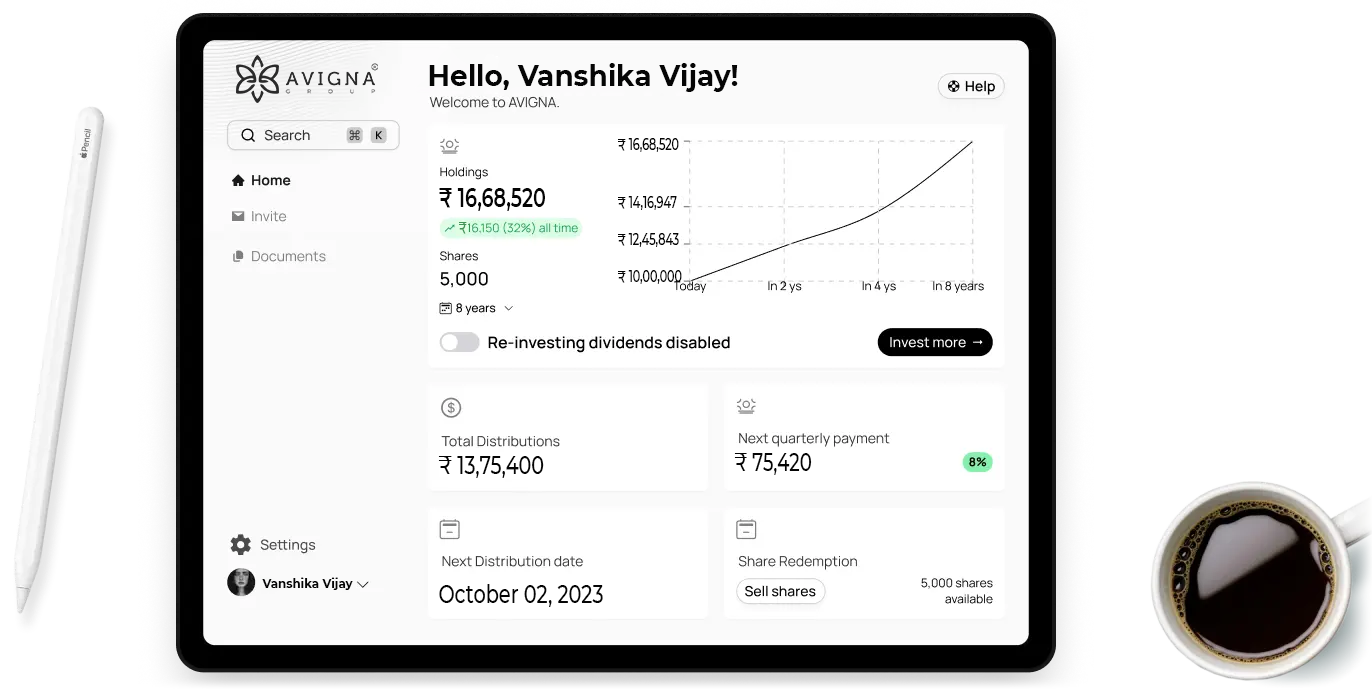

Unlock an exciting new investment product you can effortlessly

monitor and manage from Avigna Atlas dashboard.

An investment product built for Today & tomorrow

Hand-picked, Industrial Grade A warehouses tenanted

with some Blue Chip Customers across India.

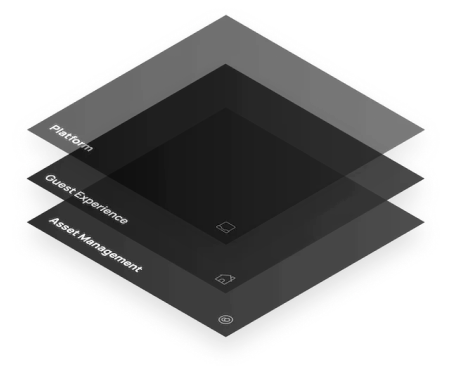

The Avigna Stack

By vertically integrating the manufacturing industry, Avigna’s goal is to efficiently deliver a superior manufacturing experience. With Avigna, investors can own a piece of the underlying infrastructure of manufacturing and benefit from everything built on top of it – a top-tier production setup packaged with warehousing and logistics services.

The Machinery

INVIT are designed to be tax-advantaged investment vehicles that invest in one or more real estate properties or related assets such as mortgages. INVIT are required to distribute at least 90% of their net income to shareholders in the form of dividends. INVIT typically invest in a specific real estate asset class such as apartments, office buildings, or hotels. Avigna is the first and only manufacturing rental INVIT (again, as far as we know).

Avigna buys properties

- Data-driven location targeting

- Hundreds of opportunities evaluated

- Rigorous underwriting process

- Licensed appraisers and inspectors

Avgina Spaces manages properties

- Customer experience (“CX”) management layer

- Park management & upkeep

- Full-featured Customer Management Services

- Value Chain Support & Services

Blue Chip Manufacturers & Logistics players rents properties

- World-class Asset management

- Automated payment management

- 24/7 Security & White Glove Services

Understanding the benefits

Let’s talk about taxes

Brought to you by our very smart accountants.

No double taxation

Unlike other corporations, because of Avigna’s special INVIT status, to the extent Avigna distributes 100% of taxable income, there is no corporate-level taxation.

Tax-advantaged income

INVIT income is optimized for income tax & prevents double taxation

JOIN 100,000+ Avigna ERS AND COUNTING

You’re not just investing in an

asset. You’re joining a community.

OUR MISSION

Avigna is on a mission to build world class Manufacturing & Logistics Infra to enable India’s entrepreneurs to better compete globally. We’re building a network of smart Factories & Warehouses across the India which the tenants can access with the tap of a button. Let’s Build tomorrow’s India together!

Origins

Avigna was born after our founder was struck by the frustrating experience of trying to build a factory ground up & how difficult it would be for a high growth entrepreneur who is focused on growing the business. He knew there should be a better way Today, Avigna offers a network smart Grade A Factories & Warehouses across India from Chennai to Hosur and Vijayawada to Cochin with new locations launching every quarter.

Today

Today, Avigna offers a suite of World Class Smart Factories and Warehouses across South India from Chennai and Bangalore to Cochin, with new locations launching every quarter.